THE GREAT DEPRESSION 1929 vs. THE FINANCIAL CRISIS 2008

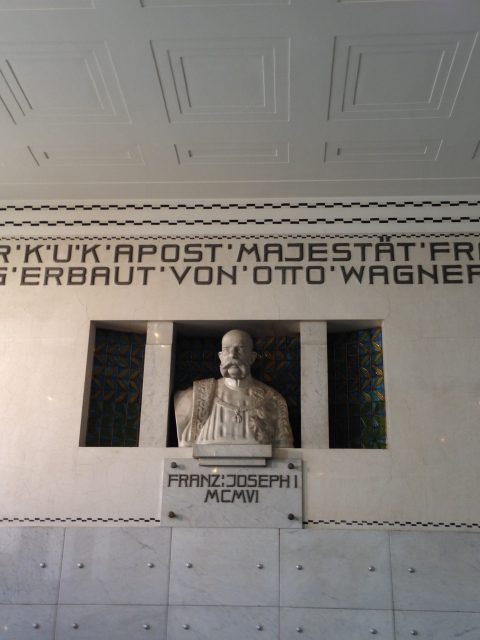

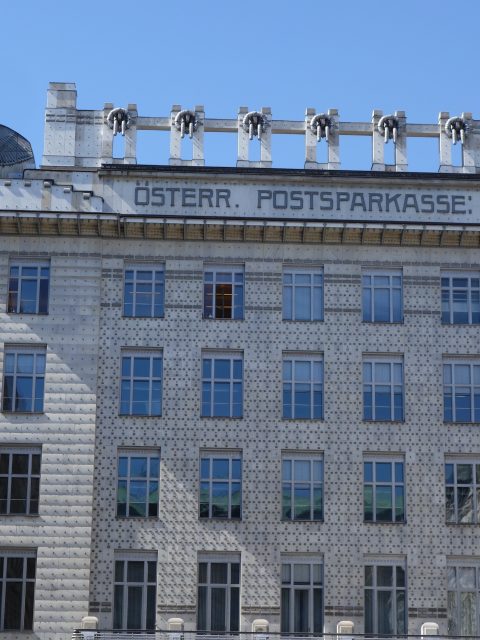

Österreichische Postsparkasse, architect Otto Wagner, finished 1906

In both cases the crisis originated in the USA. But for the Great Depression starting in 1929 in the US, there would probably have been no rise of Hitler, no Roosevelt and the Soviet System would not have been regarded as a serious economic rival and alternative to capitalism. The US which had so far been a safe haven in a world of break downs and revolutions was the epicentre of the largest global economic earthquake until then.

Operations of a capitalist economy are never smooth, fluctuations are an integral part of it. A trade cycle of boom and slump was already characteristic of the 19th century capitalist economies. In the 1920s the Russian economist Kondratiev, who later became a victim of Stalin, discerned a pattern of economic development since the end of the 18th century through a series of “long waves” of 50-60 years. He concluded that the wave of world economy was due for its downturn. The last severe downturn had been in the 1870s. Minor trade cycles had been accepted by economists, but the world economy was expected to go on growing and advancing except for sudden short-lived slumps. Only the socialists (Marx) believed that cycles could put the capitalist system at risk. The history of the world economy since the Industrial Revolution had been characterised by accelerating technological progress, continuous economic growth and increasing “globalisation”, namely an elaborate worldwide division of labour. Even between 1929 and 1933 world economic growth did not cease completely, but slowed down. Yet the globalisation of the economy stopped advancing in the inter-war years.…