THE GREAT DEPRESSION: CREDIT-ANSTALT CRISIS 1931

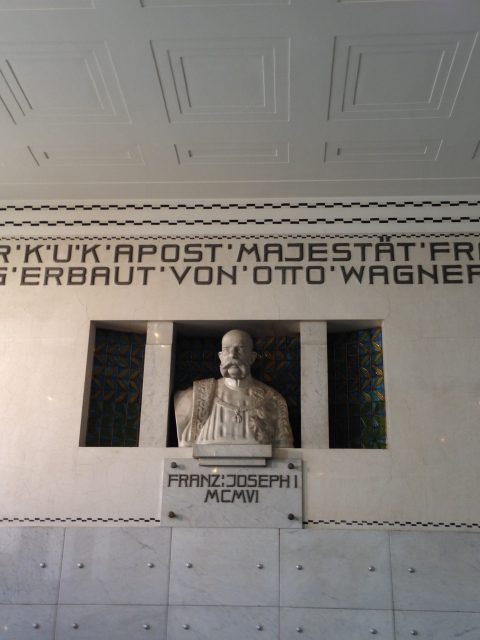

Former Österreichische Creditanstalt building, architects Gotthilf and Neumann (built 1916-1921)

The Credit-Anstalt crisis played a crucial role in the dramatic economic developments of the 1930s in Europe as the collapse of the Credit-Anstalt affected the largest bank of Austria and at that time also the largest bank east of Germany. The collapse of the Credit-Anstalt in Vienna started the spread of the crisis in Europe and forced most countries off the Gold Standard within a few months. A feeling of financial distrust and insecurity spread from Vienna and led to runs on other banks in Hungary, Czechoslovakia, Romania, Poland and Germany. The collapse in May 1931 set off a chain reaction that led from the run on German banks to withdrawals in London and the devaluation of the pound to large-scale withdrawals from New York and another series of bank failures in the United States. So in brief the news of the crisis of the Credit-Anstalt, the most important bank in Central Europe, shook the whole economic structure of Europe and sent shock waves through the rest of the world.…