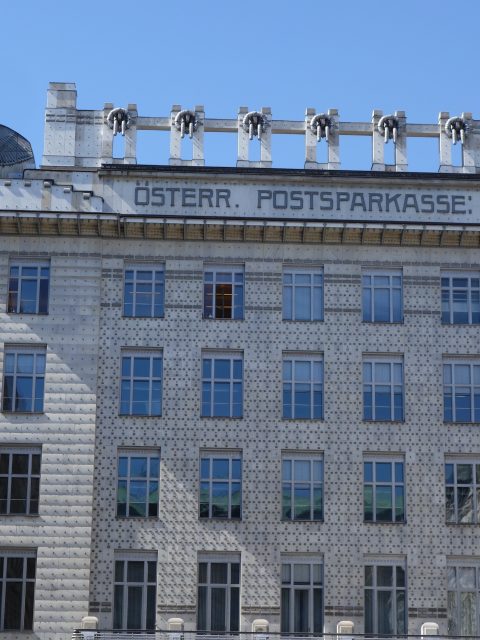

Österreichische Postsparkasse, architect Otto Wagner, finished 1906

In both cases the crisis originated in the USA. But for the Great Depression starting in 1929 in the US, there would probably have been no rise of Hitler, no Roosevelt and the Soviet System would not have been regarded as a serious economic rival and alternative to capitalism. The US which had so far been a safe haven in a world of break downs and revolutions was the epicentre of the largest global economic earthquake until then.

Operations of a capitalist economy are never smooth, fluctuations are an integral part of it. A trade cycle of boom and slump was already characteristic of the 19th century capitalist economies. In the 1920s the Russian economist Kondratiev, who later became a victim of Stalin, discerned a pattern of economic development since the end of the 18th century through a series of “long waves” of 50-60 years. He concluded that the wave of world economy was due for its downturn. The last severe downturn had been in the 1870s. Minor trade cycles had been accepted by economists, but the world economy was expected to go on growing and advancing except for sudden short-lived slumps. Only the socialists (Marx) believed that cycles could put the capitalist system at risk. The history of the world economy since the Industrial Revolution had been characterised by accelerating technological progress, continuous economic growth and increasing “globalisation”, namely an elaborate worldwide division of labour. Even between 1929 and 1933 world economic growth did not cease completely, but slowed down. Yet the globalisation of the economy stopped advancing in the inter-war years.

The USA had emerged from the First World War stronger than ever, it converted from net debtor to net creditor, won new markets from Europe, enjoyed a favourable balance of trade, mass markets, population growth and a rapid technological advance. This seemed the key to perpetual prosperity. But the new prosperity was shared most unequally between urban middle classes on the one hand and factory workers and farmers on the other hand. In 1928 American banks and investors began to cut down purchases of German and other foreign bonds to invest through the New York Stock Exchange, which led to a spectacular rise of the NYSE and a speculative boom, where many individuals with modest incomes purchased stock on credit. In 1929 Europe was already feeling the strain of cessation of American investments abroad, even the US economy had ceased to grow by then. The US GDP peaked in 1929 and then gradually declined, as well as the automotive production. Europe was already in a depression when stock prices were still at an all-time high in the US.

The trigger of the crisis was October 24, 1929 “Black Thursday” in American financial history. A wave of panic selling on the stock exchange caused stock prices to plummet and eliminated millions of US$ of paper values. October 29, 1929 “Black Tuesday”: another wave of panic selling. Stock prices kept falling, banks called in loans, forcing investors to throw their stocks on the market for any price. The US ceased to invest in Europe completely, sold existing assets and withdrew capital from Europe. This put a strain on the entire financial system of the world. Commodity prices kept falling, transmitting the pressure to Latin America and Australasia. The stock market crash was not the cause of the depression, but a clear signal.

The monthly auto production in the US fell, German unemployment rose to 2 million, in 1931 the Austrian Credit-Anstalt, one of the largest and most important banks in Central Europe suspended payments. The Austrian government froze bank assets and prohibited the withdrawal of funds, but nevertheless the panic spread to Germany, Hungary, Poland, Czechoslovakia, Romania and even Great Britain. This led to large-scale withdrawals of funds and several bank failures. Forced by the circumstances President Hoover called for a one-year moratorium on all intergovernmental payments of war debts and reparations, but that was already too late. Great Britain had to abandon the gold standard and due to the decline in prices of primary products also Argentina, Chile and Australia had to abandon the gold standard. Between 1931 and 1932 many other countries followed. Without any agreed upon international standard currency values fluctuated wildly in response to supply and demand, capital flight, excessive economic nationalism and tariff changes. Foreign trade, manufacturing production, employment and per capita income fell drastically.

The economic policies of 1930 and 1931 had been unilateral decisions to suspend the gold standard, impose tariffs and quotas undertaken without international consultation, without considering the repercussions. That resulted in the anarchic nature of the economic muddle. After the end of the Hoover moratorium, Europe agreed to a virtual end of reparations and war debt payments, but the agreement was never ratified because the US insisted on keeping the two issues apart. Thus reparations and war debts simply lapsed. Hitler declared an end to “interest slavery” in 1933; only Finland repaid its war debt to the US in full. The World Monetary Conference in 1933 was the last major effort to secure international cooperation. But the US was engaged in a presidential election and neither Hoover nor Roosevelt wanted to commit themselves, so the conference was postponed. Roosevelt took office in the very depth of the depression and declared an 8-day bank holiday for the system to reorganise itself. The measures of the famous “100 days” were taken, an emergency action to prop up the domestic economy. The US was taken off the gold standard as well. When the World Monetary Conference finally convened, Roosevelt sent word that the US’s first responsibility was to restore domestic prosperity, so they could not enter into international commitments.

What caused the depression? There is still no general consensus, but the following causes are agreed upon. First, there were monetary causes, such as a drastic decline in the quantity of money in major industrial economies, especially in the US. Second, there was a drastic fall in consumption and investment expenditure that propagated itself throughout the economy by means of the multiplier-accelerator mechanism. Third, an extreme dependence of Third World Countries on unstable markets of primary products contributed to the slump. Finally, an unfortunate concentration of events and circumstances, both monetary and non-monetary which can be traced back to World War I and the Paris Peace Treaty worsened the situation, combined with the breakdown of the gold standard, the disruption of multi-lateral trade and nationalistic economic policies since the 1920s.

The reasons for the severity and the length of the depression can be seen in the policies of the US and Great Britain. Before the First World War Britain was the world’s leading commercial, financial and industrial nation and it played a key role in stabilising the world economy. Its free trade policy meant that commodities from all over the world could always find a ready market there. Its large foreign investments enabled countries with sizable deficits in their balance of trade to obtain the resources to balance their payments. London’s adherence to the gold standard and its pre-eminence as a money market meant that nations with temporary balance of payments problems could obtain relief by discounting bills of exchange. After World War I the US was the world’s dominant economy, but was unwilling to accept the role of leader. Great Britain was no longer able to exercise leadership. Yet the US’s isolationist stance refused to accept responsibility for the world economy, characterised by its immigration policy, trade tariff policy and monetary policy and its attitude towards international cooperation. Had the US pursued more open policies in the 1920s and in the crucial years of 1929-33 the depression would probably have been milder and briefer.

The long-term consequences of the depression was the growth in the role of government in the economy, a gradual change in economic attitudes towards Keynesianism, the efforts of Latin American and Asian countries to develop import substituting industries and the rise of extremist political movements that led to world War II.

When F.D. Roosevelt took office in 1933 half of the US industrial work force was unemployed (15 million), the industry had virtually shut down and the banking system was on the verge of collapse. The US was also faced with a social crisis; unemployed veterans of World War I and farmers took the law into their own hands to prevent foreclosures, there was violence in the cities. The volume of legislation of the four years of Roosevelt’s first term surpassed any previous administration. His programme “New Deal” comprised economic recovery and social reforms in the areas of agriculture, banking, the monetary system, the securities market, labour and social security, health, housing, transport, communication and natural resources – virtually every aspect of US society and economy. The National Industrial Recovery Act (NIRA) included codes of fair competition for each industry, a system of private economic planning with government supervision to protect public interest and guarantee the right of labour to organise itself and bargain collectively. In 1935 NIRA was declared unconstitutional. Roosevelt ran a campaign of trust busting to ensure fair competition and break up monopolies. Despite this regulatory effort a new recession set in in 1937.

There is no consensus definition of “depression”. Harvard University economist Robert Barro defines it as a decline in per person economic output or consumption of more than 10% and puts the odds of a current depression at about 20%. Many economic historians say the line between recession and depression is crossed when unemployment rises above 10% and stays there for several years. In the US unemployment was just below 10% in May 2009, whereas it reached 25% in the Great Depression. In a Wall Street Journal poll conducted in March 2009 economists put the odds of a depression at 15% on average using the Barro definition. But there was wide disagreement. Many believed that there were many powerful counter-cyclical policies in place which would prevent the worst-case scenario. The US government response was a far cry from the early 1930s, when the FED raised interest rates, the infamous Smoot-Hawley Tariff Act of 1030, which raised US tariffs on over 20,000 goods to record levels and crushed trade, and the Treasury Secretary’s prescription for the economy was: liquidate labour, liquidate stocks, liquidate the farmers and liquidate real estate. So a mass of policy errors made the situation worse in 1929.

The different structure of the 21st century economy means that a modern depression would differ from the 1930s’ version anyway. Firstly, fewer than 2% of Americans hold agricultural jobs nowadays, compared with one in five in the 1930s. Three quarters of today’s workers are in service-related jobs, which tend to be more stable than manufacturing, compared with fewer than half of the work force in the service industry during the Great Depression in the US. Secondly, there are social safety nets that emerged after the Great Depression. Then there was no unemployment insurance, no food stamps, no social benefits that maintained some kind of income for people out of work. In Europe the social safety net is nowadays much tighter than in the US which might among other factors explain why in many European countries the consequences were not so life-threatening to families as in the 1930s. Thirdly, with spending on food accounting for a little less than a tenth of a typical family’s disposable income today, compared with a little less than a quarter in 1930, a modern depression would hit the people less in this respect. Today’s cut backs would be for more discretionary purchases, such as cable TV, restaurant meals, etc. for a large part of the population, with the exception of really hard-hit regions like Greece.

Literature: Cameron, Rondo, A Concise Economic History of the World, OUP 1997

The Wall Street Journal Europe, March 30, 2009