THE ROLE OF AUSTRIAN BANKS IN NAZI GERMANY’S EXPANSION TO CENTRAL, EASTERN & SOUTH-EASTERN EUROPE

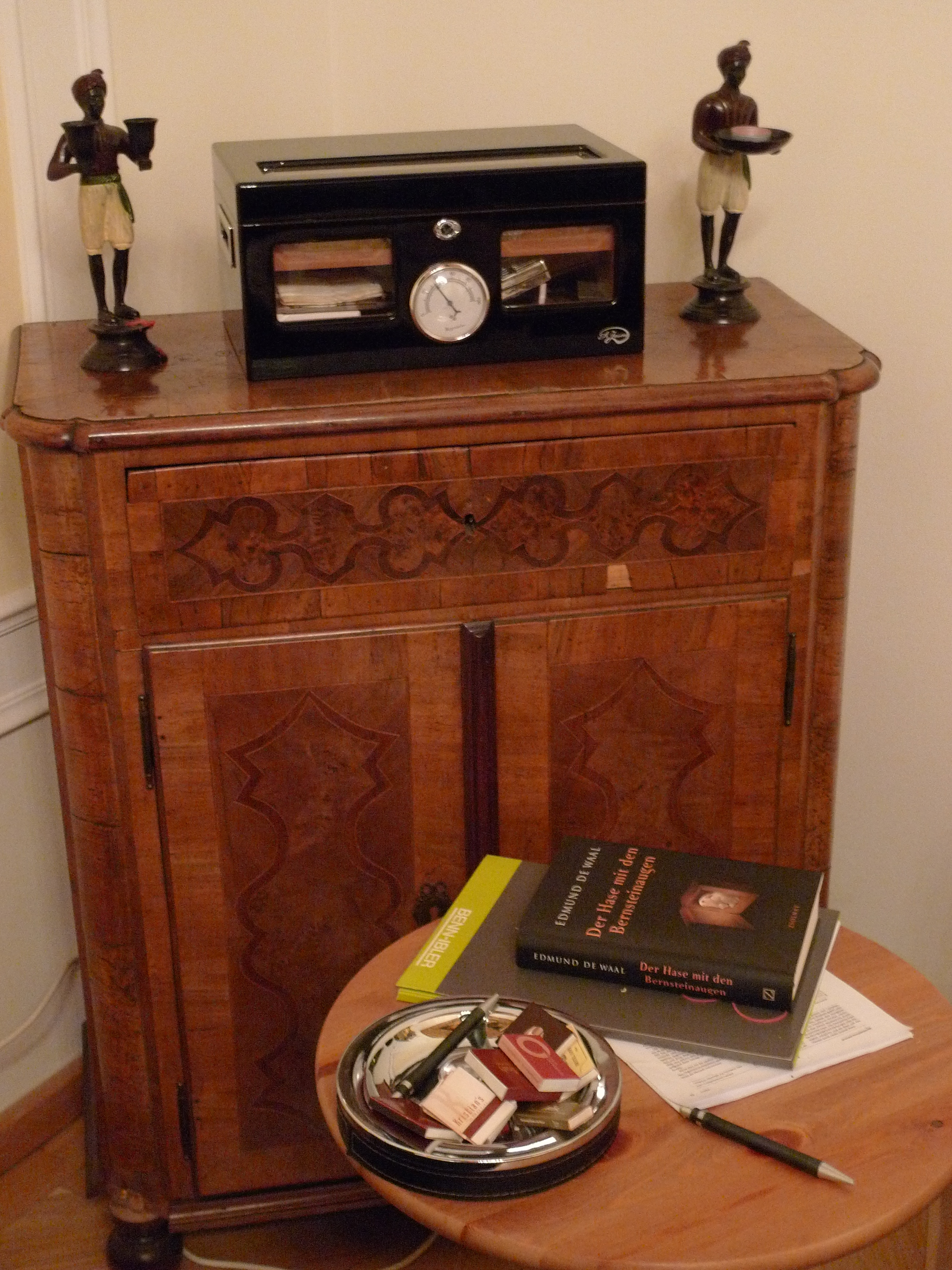

Palais Ephrussi, Viennese Jewish banking Family (exiled): Edmund de Waal, “The Hare With Amber Eyes” describes the destiny of this banking family

The German state-owned VIAG (Vereinigte Industrieunternehmungen) and the Deutsche Bank gained control of the majority of shares of the Creditanstalt-Bankverein CA from the time of the “Anschluß” of Austria to the Nazi German “Third Reich” in 1938 onwards, originally by taking over the shares of the Austrian state. From the very beginning the German majority shareholders viewed the bank as an important tool for German penetration into South-Eastern Europe, not only because of the geographical position of Vienna, but also because the Viennese banks, many of which had merged with the Credit-Anstalt in the interwar years, had been very active in this area before 1918 and still had much experience in the region. Contrary to the image the CA wanted to create after 1945, the leadership of the CA, and especially its most important director, Josef Joham, viewed the German takeover of Austria as an opportunity to recover the position the CA had held in South-Eastern Europe before and to turn Vienna into the financial hub of the Nazis’ activities in Central Europe and the Balkans. In fact, the CA often took the initiative in expanding its banking activities in the German satellites and occupied territories. It constantly made reference to its historical role in the region and viewed its acquisitions as restitution and/or compensation for its losses and exclusion by the successor states after the collapse of the Austro-Hungarian Empire. The German control of Austria and the CA provided a welcome opportunity to restore the position Viennese banks had enjoyed during the Austro-Hungarian Empire. The close co-operation between the CA and the Deutsche Bank, namely between the two directors Josef Joham and Hermann Josef Abs, had already started before the “Anschluß”. As Joham had supported the old regime in Austria, but anticipated the “Anschluß” of March 1938, he sought protection for himself and the bank through the alliance with Abt and the Deutsche Bank. Yet first the German VIAG took over the majority of shares from the Austrian state and Deutsche Bank got hold of only 25 per cent of the shares of the CA, but in 1942 the Deutsche Bank finally acquired the majority of shares in the CA.…